Worried About a Recession? Here Are 3 To-Do's and 3 Not-To-Do's

- Doug Oosterhart, CFP®

- Aug 29, 2019

- 5 min read

Updated: Jan 20, 2020

First, let's start by defining what a recession is - it's a decline in the economy for at least six months (two consecutive quarters). There's a drop in the following five economic indicators: real gross domestic product (GDP), income, employment, manufacturing, and retail sales. It's a common misconception to think that a recession is when the stock market crashes. The market correcting or going lower is/can be a byproduct of a recession. Here is the problem: no one can predict exactly when a stock market downturn or recession will happen, so here are 3 things you can do if you're approaching retirement and 3 things you shouldn't do.

The To-Do List:

1. Use Math Based Rules When Trading or Making Portfolio Moves

If you're in retirement or in the stages where you're taking income from your portfolio, there are mathematical ways to make sure you position yourself to never run out of money. I'm a fan of the guardrail approach. Let's say you've accumulated $1,000,000 and you are planning to take out $40,000 annually (a 4% withdrawal rate). If the portfolio goes down to $800,000, the same $40,000 taken from it would equate to a 5% withdrawal rate, which may not be sustainable over a 30 year period. In this case, a "guardrail" rule would be in effect on the portfolio and you'd get a 10% decrease in your income for the next 12 months (instead of $40,000, you'd receive $36,000). This would be a rule for a lower guardrail. The same would work if the portfolio went up. If the portfolio grew to $1,200,000, you'd get a 10% increase in income ($40,000 would turn to $44,000). Having a math based approach to taking money out of a portfolio can increase the chances of success substantially. If you're still years away from retirement, the math based rule to follow deals with rebalancing. Since it's impossible to guess correctly when the market is at the bottom, one way to invest is to add money or rebalance your accounts after each 10% decrease. Example: if the S&P 500 declines by 10%, it may be time to rebalance (buy more) since prices would be considered to be "on sale." The key is to use downturns to your advantage - not be scared of them.

2. The Percentage of Bonds You Own Has Nothing to Do With Your Age

A common misconception is that you should have 100 minus your age in stocks or bonds. This isn't true. The amount of bonds or cash you own should be based off of the amount of income you need in retirement. Continuing with the example from above, if you're planning to take out $40,000 annually from your $1,000,000 portfolio, and you want to maintain 3 years of income in bonds and cash, holding $120,000 in bonds/cash accomplishes that goal. However, $120,000 out of $1,000,000 is only 12%! That could be considered "too aggressive." It's important to work through the proper allocation based on your risk need AND risk tolerance. That being said, if you're approaching retirement, the idea of a bond tent could be attractive. In layman's terms, increasing your bond (or less volatile/safer) allocation if you're only 5-7 years away from retirement. Instead of holding a 70/30 ratio of stocks to bonds, maybe holding a 50/50 ratio instead. Continue holding the higher percentage of bonds for the first 7-10 years of retirement and then decrease the percentage to actually hold less bonds as you get older. Sounds like the total opposite of conventional thinking, but the goal is to have lessened portfolio volatility when your portfolio is the largest - which is usually at the beginning of retirement!

3. Increase Your Cash Buffer

Sounds basic right? Here's what I mean. If we continue with the example above, for retirees, instead of holding 3 years of income in cash/bonds, maybe holding 5-6 years of income in less volatile assets could be the way to go. If we look at this history of market ups and downs, generally downturns have lasted no longer than 2 years historically, with the longest being about 3 years (Great Depression). Click here for a link to a PDF showing the history. The goal here is to plan that when there is a downturn, you do not have to sell assets after they go down. You want to be able to live off of assets not in the stock market, wait for a recovery, and then continue with your plan. If you're still saving for retirement, adding a larger cash buffer isn't a bad idea either. During recessions, job loss can be real for some people, so making sure you can weather a storm is key. You don't want to have to withdrawal money from retirement assets.

Now For the Not-To-Do List:

1. Do Not Move All of Your Assets to Cash

People often think that cash is risk free - false! Generally, cash doesn't keep pace with inflation, which actually makes it worth less year after year. I like to tell clients that although stocks can kill you fast (if you sell at a loss), inflation can kill you slowly. When I run plans for clients, I like to show them how their probability of success actually decreases if they held all of their assets in cash.

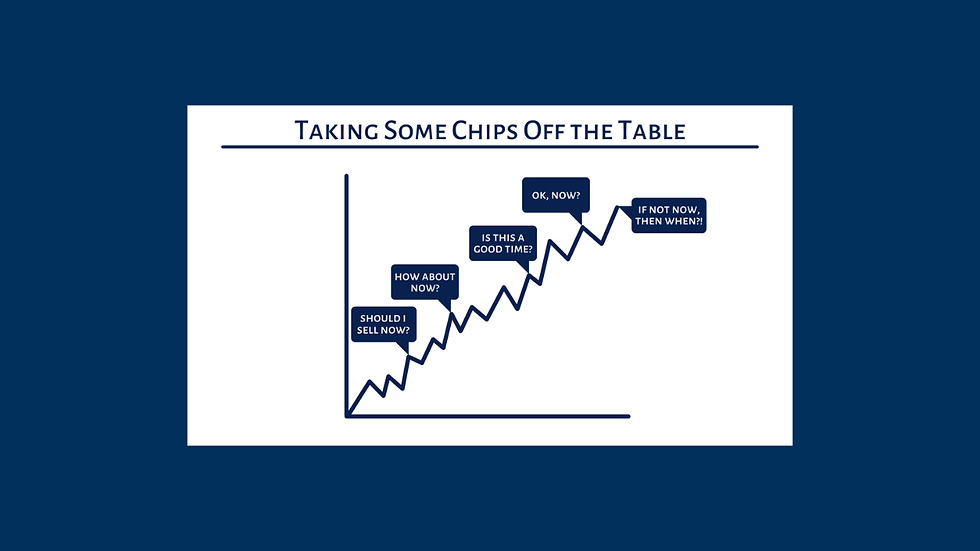

2. Do Not Time the Market

If you think that "now is the time" to get out of the stock market, how can you be sure? There is literally no evidence that ANYONE can consistently time the market well on a long-term basis. You have to be right twice - at the peak of the market, and at the bottom of the market. The truth is, you can never be certain. Generally, what happens is that people become paralyzed in their emotions after they move money out of the market and they never get back in. I've met multiple people that have had multiple 6-figure amounts of money sitting in cash since 2008 - since then, he market has grown 300%+.

3. Do Not Make Portfolio Changes Based Off of the News

Here is a quote from the book, Simple Wealth, Inevitable Wealth: "Journalism, by its nature, stays in business by selling you the news - which is timely - as opposed to the truth, which is timeless."

Everyday there is a new story posted about, "How to Change Your Portfolio Based on Today's Volatility." Please do not give in to these headlines. The market never moved based off of one-thing and one-thing alone. There are generally numerous factors that go into the market's daily movements. Your investment portfolio is simply a funding medium for your plan in order to meet your goals. If your goals haven't changed, chances are your investment portfolio shouldn't change much either.